News

Could Inflation Be a Friend and Not a Foe?

When inflation increases, people often feel the sting of paying more for groceries, gas, and almost everything else. Many may feel inflation is terrible because their paychecks are shrinking, and they don’t like paying more for the same items. But inflation also has positive benefits that may occur over time, such as:

How Pets Could Impact Your Taxes

Many view pets as part of their family and essential to their happiness and mental health. Pets can be an added expense as they may need special diets. Or even require veterinary services, and in some cases, pet daycare.

How Debt Holds Families Back from Financial Confidence

Debt can hinder financial confidence when you spend more than you make and borrow using credit. Other financial problems may occur, such as inadequate emergency or retirement savings.

10 Actions That Help You Pursue Financial Wellness

Establishing financial wellness is a personal, ever-changing state of being that enables one to exercise choice while feeling in control of finances.

The individual determines financial wellness, which often includes working toward financial goals by completing specific actions. Some actions are time-sensitive, but others can occur anytime throughout the year. Here are ten actions that may help keep your finances on track as you pursue financial wellness:

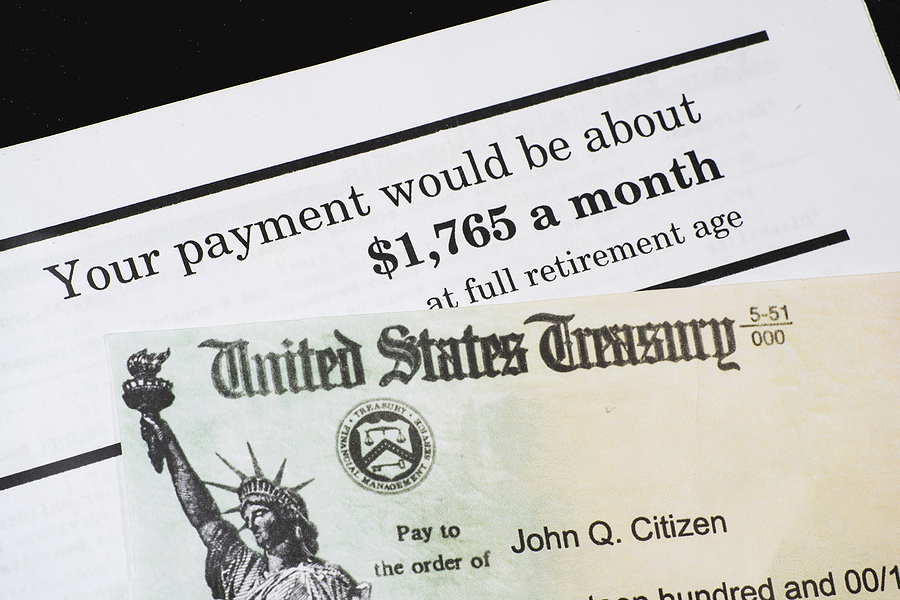

When Can You Collect Social Security?

Knowing the situations and critical ages of when to start Social Security benefits is essential. The age when you start to collect social security benefits impacts the amount you receive.

Why Wealth Management Is Important for Women

Today, women control a third of household assets one major reason why wealth management is important. But by 2030, U.S. women are expected to control much of the assets that the baby boomer generation will pass to heirs; roughly 30 trillion in assets.

Social Security COLA May Be Less in 2024

For 2023, Social Security Retirement and Supplemental Security Income (SSI) benefits increased due to inflation. The increase was 8.7%, resulting in an average monthly benefit increase of $146 per month for a yearly increase of $1,827 in 2023.

6 Tips to Help You Save on Summer Travel

If you love to travel, summer is a great time to do so and have new experiences near home or far away. As you plan, remember to budget for travel expenses and look for ways to save during the peak summer travel season.

National Financial Freedom Day: 10 Tips to Work Toward Financial Freedom

National Financial Freedom Day is observed each year on July 1ST. This holiday raises awareness about financial freedom and how it may improve your financial stability. Financial freedom is controlling one’s finances, covering expenses, and saving for future goals.

Insurance Awareness Day: Time to Assess Your Risk

Insurance Awareness Day, recognized on June 28th, is a great time to review your insurance coverage and assess your risk. Insurance is a means of protecting your assets against premature liquidation and protecting yourself and your loved ones.